The last few days of Chinese New year holidays allowed me to spend some time on SGD INR analysis. I always had a feeling that transferring money to Indian specially with a view to play on the interest rate differential would not have been beneficial in the last year and I had to test my feeling against some actual numbers.

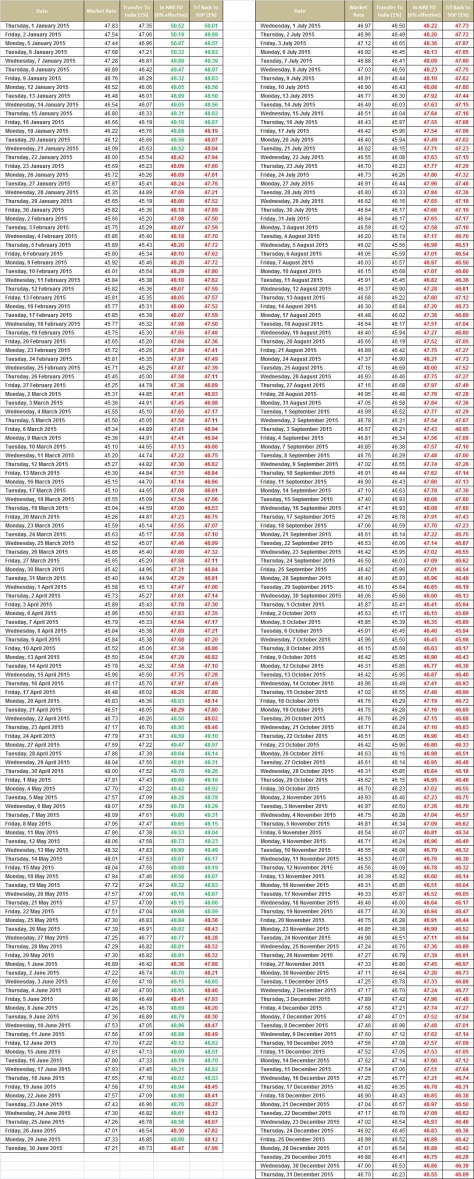

I took the average investable Tax Free NRE FD rate as 8% and cost of transferring money as 1%. The interest that someone could earn in Singapore was taken as average of 2% (DBS Multiplier, OCBC 360, UOB One or some money market funds) which brought the effective interest rate differential as 6% (8% – 2%).

There might be a few of you who could have got slightly better NRE FD rates and also managed a better transfer rate, however in my observation banks or transfer services usually charge anywhere between 0.8% to 1.5% as remittance fee. This fee could be charged as a out right fee or built into the exchange rate that they offer you. Similarly I took the cost of transferring money back from India as 1% as well though people tell me it can be close to 2%. I have personally never transferred money from India so just went in with the 1% charge.

The result of number crunching vindicated my gut feel – there were only 39 days in 2015 (around 11%) which provided a better return if someone transferred money to India, invested in NRE FD and transferred it back to Singapore as compared to keeping money in Singapore and starting to transfer to India once SGD INR crossed 47.50.

Interestingly of those 39 days 12 were in Jan 2015 and remaining between 24th April to 22 May and few in mid June.

The number of days went up to 62 (around 20%) if the person decided to leave money in India instead of bringing it back but the period of transfer remained in first half of the year.

Anyone who panicked and transferred money since July would be “out of money” based on today’s DBS remittance rate of 48.50 (Market rate around 48.90).

Of-course the rates can and will change in the coming days and a few more days of 2015 might become “In the money” but I would rather transfer around 48 than at 46 – it translates to gains of around 5%.

Hi Aditya,

I am Indian, who has always been advised of repatriating money to India and make FD for sake of better interest rates. However , I have always held that the currency risk or value of money lost thru exchange rate change s ore than the interest earned . This is on the premise that I bring back the money to Singapore . And assuming we bring back money only after 3 years. Is my argument correct

LikeLike

Hi Karmaguyca,

The assumption might or might not hold good depending on when one has transferred. If you transferred to India when exchange rate was 49 and brought back when it was 46 then you would have gained a fair bit. However if the entry and exit points were reversed you might barely break even.

LikeLike

I guess we are in the money now for most of days of transfer in 2015. It would be great if you could recreate this table by the end of 2016. It will be interesting to see.

LikeLike

Hi Aditya, any thoughts on SGD-INR rate in next 2-3 months?

LikeLike

Hi,

It should cross 50 between now and 22nd June. After that the INR weakness would persist unless Raghuram Rajan term is extended. India also has to pay the FCNR bill due in Sep which will add to Rupee weakness. I would not be surprised if SGD INR touches 52

LikeLike

Hi Aditya, SGD- INR is at 48-49 range for sometime. would you know why we are INR is weak off late and if there are any genuine reasons behind it. do you expect it to break 50 anytime soon, regards

LikeLike

Hi Sushant,

The SGD INR is a depends on the USD rates of the 2 currencies. INR has been stable to strong against the USD but SGD has been relatively stronger which has kept SGD INR range bound. INR will weaken very quickly if Raghuram Rajan does not get a new term or if Fed Increases the rates in June. On a rate increase in July SGD INR might get into the 49 – 50 zone.

LikeLike

Hi Aditya,

Do you think it will be a good idea to transfer money from India to Singapore during Mar 2016?

I am planning to do some investment in Singapore.

LikeLike

Hi Veera,

There are many aspects to a remittance decision like are you going to borrow in India, what kind of return the investment in Singapore will give you, can this investment be deferred, if yes then for how long, tax implication, your residency status in 2 countries, mode of transfer etc etc… Based on the above my answer can be yes its a good idea for one person vs no its not for the other.

Thanks

LikeLike

Hi Aditya,

How it will be the budget impact on sgd to inr conversion…..

Looks Rupee is gaining….

Is sgd will go back to <47 Inr.

Thank you,

Srinivas…

LikeLike

Hi Srinivas,

Wait for my next post where I analyse it however budget is not the only factor that impacts the exchange rate. There are macro economic factors also to be considered along with fine print of the budget. One of the most interesting things I read was that govt plans to increase infrastructure spending by 11% and fund that through taxes on petrol and that can backfire big time.

LikeLike

Hi DS,

It depends on which country you consider to finally retire and which currency you consider as your “home” currency. Most people on this thread consider India as home and INR as our home currency, so for us keeping in SGD is the FX risk. Since you are Singaporean and if you want to retire in Singapore, then you are taking a huge huge risk converting 555k to INR. That’s a lot of money. I would suggest, keep it in SGD and put it in diversified assets. Build a good portfolio if equity, bonds, reits and gold.

LikeLike

Aditya, on D.S’s question is there a tax on the interest earned ? either in India or Singapore that needs to be factored ?

LikeLike

Sunil, 2 scenarios:

Tax in India – NRE account income is tax free in India and fully repatriable

Tax in Singapore – There is nothing in the act that is specific to overseas interest income scenario for Individuals but based on the below 2 clauses I believe its tax free in Singapore as well (please check with your tax planner for confirmation, this is my interpretation and I am not qualified to give tax opinion in Singapore)

https://www.iras.gov.sg/irashome/Individuals/Foreigners/Learning-the-basics/Individuals–Foreigners–Required-to-Pay-Tax/#title1

As a tax resident:

……..

Your foreign-sourced income (with the exception of those received through partnerships in Singapore) brought into Singapore on or after 1 Jan 2004 is tax exempt.

https://www.iras.gov.sg/IRASHome/Individuals/Locals/Working-Out-Your-Taxes/What-is-Taxable-What-is-Not/Overseas-Income-Received-in-Singapore/

Taxable Overseas Income

Overseas income is taxable in Singapore if:

a) It is received in Singapore through partnerships in Singapore; or

b) Your overseas employment is incidental to your Singapore employment i.e. your work overseas is part of your work here.

c) Employed Overseas on Behalf of the Singapore Government

LikeLike

Dear Aditya,

Thank you for the prompt and enlightening response to my query.

I will ponder on it for a while before I make any move. Any further information, advice or feedback from you would be hugely beneficial and welcome to me.

Best Regards!

D. S

LikeLike

Hi Aditya,

I am a Singaporean holding an OCI status.

I plan on opening an NRE account shortly, investing around 550,000SGD.

My objective being ,to utilize the monthly interest here in Singapore.

According to my very rough and layman’s calculation, I try to be conservative, envisaging worst case scenarios by calculating SGD to INR at 46 for buying INR; and thereafter SGD to INR at 48 to buy back SGD each month.

Using 555000 SGD as principle, after conversion, I have 25,300,000.

Based on 7.9%,FD as NRE,I arrive at 1,998,700 INR per annum.

Monthly around 166,558 INR.

Converting back to SGD at a higher rate now of 48, gives me around 3470 SGD.

I assume the padding I have incorporated(2 INR) in conversion should cater to any conversion charges.

My intention is to use that 3470 SGD in Singapore each month.

Have I left out any variables(besides the obvious ambiguity of daily variations in the exchange rate)?

Is it a good Move?

I have no experience nor knowledge in these matters, I am a working professional.

I understand the implications or repatriating the funds back to SGD too soon…I will loose in the conversion again, however ,if I were to leave it for a longer, indefinite duration in a FD, would it prove to be a lucrative investment?

Thanks and regards!

D.S.

LikeLike

Hi D.S.,

One of the first things to consider would be the fact that none of the NRE Fd’s will give you a monthly interest pay out. Most would be semi annually with a few that might pay out quarterly which would result in uneven cash flow.

I dont think SGD INR will go down to 46 in next 3 weeks (usually the time taken to open a NRE account) and you should be able to convert around 48 mark.

Another factor to consider would be changes in NRE FD rates, they might come down and longer term FD’s would have a slightly lower rate. With a larger amount like yours I would recommend opening more than one NRE account to diversify the Bank default risk. NRE deposits are not insured by RBI / Govt of India incase of bank defaults.

To answer your last question will it be a lucrative investment – It will be a relatively low risk investment and will give you a predictable cash flow, however if it turns out to be a fantastic return investment will depend on future exchange rates.

Thanks

LikeLike

Hi Just wanted to know anyone know how the home loan prepayment works for example total loan amount it 30lac INR with interest rate of 9.60% and monthly EMI will be around 32,000. Suppose after 1 year wanted to pay 5 lac then how they reduced it from loan, Is it a good option by taking balance transfer from Singapore and prepay some amount in loan.

LikeLike

Hi Aditya ,

What’s your take on February -March 2016 sgd to inr analysis .i am planning to transfer around 20k in feb . Shall I wait or not as today rate is quite good it has crossed 49 .

Thanks in advance

LikeLike

Hi Someone,

I can’t predict the top and the bottom of a financial instrument. Any Rate above 48 is a very good rate to transfer. There is a possibility that sgd INR might touch 50 by the month end and it’s equally possible for the pair to retrace back to 47.50. It all depends on what the central banks do

LikeLike