It’s a very interesting phenomenon every time SGD INR falls – people panic and there is a flurry of questions on SGD INR’s future. To me this anxiety is similar to a house owner checking on the market rate of the house they live, every week, and feeling sad if the latest transacted price in the neighborhood went down or celebrating if it goes up. In reality, this is just perceived loss/profit and is irrelevant unless the person is trading in properties and regularly buys and sells them for a living.

Anyway, leaving perceptions aside, lets look at how Indian Rupee has really performed against major currencies in the past 3 years before I turn my focus to SGD INR.

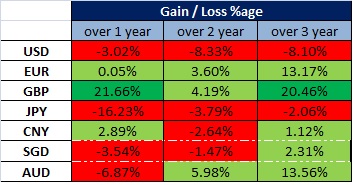

The Rupee has fallen against USD and JPY, against Chinese Yuan and Singapore Dollar its a flatline and the gains against EUR and GBP are not because Rupee has fundamental strength against them but because the 2 currencies have weakened due to their own issue – ECB monetary stimulus and Brexit vote respectively.

Also worth highlighting is Rupee’s inherent volatility where it went from 68/69 against the US dollar in Aug 2013 to 58 around Election time in 2014 and is back up at 67 mark – all in a matter of 3 years (refer comparative 1, 2 and 3 year charts at the end)

There is no doubt that the Rupee has been pretty stable in the past few months and the RBI has done a fantastic job of curbing the volatility in the face of BREXIT, expected US fed rate rise, Increasing Oil Prices,Redemption of FCNR deposits and escalating tensions with Pakistan.

But have the rupee or economic fundamentals changed to much in past few months? -I don’t think so.

India still imports 80% of its crude oil and as oil prices go up they would put a strain on the current account, the goods manufactured in China are still way competitive both in terms of cost and quality (maybe that’s why rupee is following the Yuan trajectory) and the NPA situation with Indian banks is still worrisome and could result in market turmoil.

Investing in NRE FD’s has generated stable returns depending on when one invested, refer – (https://adityaladia.com/2016/02/11/you-would-be-out-of-money-80-of-days-if-you-transferred-money-to-india-in-2015/) and would slowly stop being an attractive avenue as the interest rates in India go down.

Now coming to SGD INR, the current weakness is mostly due to flurry of bad news (or expectation management as I call it) on the economic and employment front. I have always maintained that the MAS is pro-active and lets the SGD adjust quicker to the market events as compared to what RBI allows or can allow with the INR.

All the expected or known negatives are already priced into Singapore Dollar and any other movement would be due to fed rate decisions. Even after the news of GDP missing estimates the SGD only fell around 1% which is very normal in the current volatile markets.

On the other hand there are a lots of factors for the Indian Rupee that needs to be priced in – merger of banks due to NPA’s, challenges for exports due to relatively strong rupee – China and other ASEAN countries, increase in crude oil prices, looming fed rate increase and of-course any escalation on the international borders with Pakistan.

As with the answer to keeping money in Singapore Dollar or remitting to India, the response is unique to every individual depending on their investment portfolio, diversification, cash flows and risk appetite.

48 would act as a very strong support and do factor in the cost of transferring money into India and remitting back, the cost of loan (if you are taking one) and tax obligations if you invest in property or stock markets when making any such decisions and don’t get stuck on specific numbers – transferring money at 49.80 is just as good as transferring at 50.

————————————————————————–

INR performance – past 1 year

INR performance – past 2 year

INR performance – past 3 year

http://www.financialexpress.com/industry/banking-finance/dollar-is-a-myopic-scope-to-judge-how-well-the-rupee-is-doing/622102/

LikeLike

HI Aditya

its fallen considerably today, will it continue to fall through the rest of the year

Thanks

Sandi

LikeLike

Hi Sandi

I dont think it will fall for the rest of the year. This week’s MAS meeting should correct the downward trend.

LikeLike

Hi Aditya

What are your views in SGd- INR in next 2-3 months?

Thanks

LikeLike

Hi Reddy,

It will hover around 47.

Thanks.

LikeLike

Aditya, what is your year end target for SGDINR for 2017? I have this feeling that INR will steadily depreciate against USD, but not so much against SGD. My worst case for USDINR for this year is 75, which is 10% depreciation. This will take SGDINR to 52, even if USDSD remains at current 1.43 levels. So my target for SGDINR this year is 52, worst case scenario. Best case is 50.

LikeLike

Nitin, I think 50 would be a likely number and a lot would depend on upcoming budget and elections. Yes, usd INR should go towards 75 and sgd usd stay around 1.45 mark.

LikeLiked by 1 person

Looks like the rally in SGD vs INR is over for now. 48 couldn’t get crossed convincingly. I see a move down again towards 47.

LikeLike

Aditya,

How do you see SGD-INR in 2017 and 2018?

LikeLike

Rajan,

Making long term predictions in these markets is near impossible. I could give a large range like between 44 and 54, but in all honesty it is useless if one is trying to plan investments. Looking at fundamentals Indian rupee is overvalued and a fair rate for SGD INR should be 50.

LikeLike

Good blog! Keep it up Aditya

LikeLike

Thanks.

LikeLike

Aditya, both DBS and Money2India(current indicative rate) are currently offering 47.02.

The drawback of Money2India is that although their indicative rate is good, you need to wait for 1-2 day to get it. So actually you get a future rate. So that risk is there that 1-2 days later spot rate may be bad and you will get based on that.

So DBS still wins. But in my case I don’t want to keep DBS account. I use OCBC 360 account so my choices are Money2India or yes remit. But I prefer Money2India as it is simpler.

LikeLike

Yes, one should use what is convenient and it would be worth checking if money2india rate changes during the day. I think it would update after 4pm.

LikeLike

Yesterday i used stan chart..i got 47.17..

LikeLike

Is there a easy way to check the current rate that Standard Chartered is offering? I can’t see anything on their site that shows the current INR rate

LikeLike

When they started remit service they used to show the rate but now it doesnt..only before confirming the transaction it shows..if u have account u can go till the confirming page to know the rate..but i m sure the rates are better at least till end of jan..after that we need to watch..

LikeLike

I have an account and it still doesn’t show the rate unless I add a beneficiary and initiate a transfer. It seems to be there desperate attempt to have people open account with them

LikeLike

Couple of gloomy articles in mainstream media:

http://news.asiaone.com/news/business/sing-dollar-may-no-longer-be-among-worlds-strongest-future

http://www.straitstimes.com/business/singapore-businesses-fear-worse-economic-situation-in-the-coming-year-sbf-survey

It’s almost like warning before the storm.

LikeLike

And the reality turns out to be different

http://www.businesstimes.com.sg/government-economy/singapore-gdp-surprises-with-18-full-year-growth-in-2016

LikeLike

Indian Forex reserves are steadily declining

“India’s foreign exchange reserves declined by USD 935.2 million to USD 359.671 billion in the week to December 23 on account of fall in foreign currency assets…….They had touched a life-time high of USD 371.99 billion in the week to September 30, 2016”

for me the key is a 12 billion drop in 3 months, which means that RBI is burning through reserves to keep Rupee stable, if oil prices spike then this policy of defending Rupee will start to hurt even more

http://economictimes.indiatimes.com/news/economy/finance/forex-reserves-fall-by-935-2-mn-to-359-671-bn/articleshow/56256530.cms

LikeLike

Hi Aditya,

Please do help understand your take on the recent fall in SGD INR rates to sub 47 levels. Do you reckon the SGD will fall further in 2017 or there is a expectation of improvement in the conversion rates.

thank you.

regards,

S

LikeLike

Hi Susheel,

The negatives for SGD are already priced in the current exchange rate whereas for INR the negatives have to be priced in. The game is no longer about SGD weakness but of artificial Rupee strength.

RBI would do everything to keep the exchange rate stable but given the global markets the longer they wait to let Rupee touch 70 against the USD the higher the economic pain is going to be. So yes, I expect SGD INR to be back above 48 depending upon what capital controls govt introduces post 30th Dec deadline.

LikeLike

Hi…. I need to transfer 50K SGD to India….do you think the rate will increase from 46.7 or it will fall

LikeLike

From what I read, Rupee is expect to hit 72.5 by 2017 and 75 by 2018, to the USD. You can wait for spikes in the SGDINR and transfer to India. Last time when it hit 50 it was a great opportunity. I believe similar opportunities will come next year.

LikeLike

Hi Aditya,

SGD to INR, what will be the low range in one or two months?

Thanks& Regards,

Srinivas

LikeLike

47 should be the absolute rock bottom unless RBI really wants to distort the market for some other reasons. Maybe some big ticket govt payments to foreign companies (Rafael purchase, defence expenditure) are due which is making RBI prop up the Rupee.

LikeLike

Nice article:

https://www.bloomberg.com/news/articles/2016-12-08/rupee-carry-appeal-burnished-by-india-rate-surprise-as-fed-looms

LikeLike

This is the gloomiest article I have seen on Singapore on mainstream media:

http://news.asiaone.com/news/business/singapore-stresses-under-wealth-worries

Reference to Singapore being the sick man of Asia. Now that is a huge blow.

Although I have realized one thing. The exchange rate can remain low for the whole year, but one spike up once in a year is enough to transfer money to India. For example in Jun this year there was a blip SGDINR touched 50. Rest of the year it has languished at 48. So you can still win by holding dollars and waiting for the spike.

LikeLike

Brilliant move by RBI. Have a look at where the Rupee has ended v/s he Dollar 🙂

LikeLike

Yes the stock market fall hurts. I have about 22% of my networth in Indian Equity MFs. I hope over the long term markets recover. With rates falling and RE and Gold both getting hit, I hope more household savings come into equities. I am bullish in the long term. Looking for opportunities to buy any fall and will increase my allocation to 35%. Rest of my money in NRE FDs has done well.

LikeLike

Also bear in mind some fall in the reserves is due to cross currency effects because all currencies have fallen significantly against the US dollar. Gold too has fallen. Reserves are held in multiple currencies and Gold too. But reported in USD. So in neutral currency terms the reserves fall has been much lower.

I won’t be too worried. INR will do fine.

LikeLike

The key is cost of goods or purchasing power parity which is definitely not great. Real effect of the demonetization move will be felt in next quarter and if Indias economy was doing that good why has stock market fallen by over 15% in past year when Nikkei and NYSE have gone through the roof

LikeLike

Compared to the reserves in 2013 when rupee was is free fall the current reserves figure is huge. Also this small fall in reserves from the peak is despite the FCNR outflows.

Regarding Rupee at 68.5. It is super strong considering how SGD and other currencies have fallen. Always you must take into account India’s superior bond yeilds. So Rupee now at 68.5 vs 3 years ago means rupee is atleast 25% stronger. Now even if rupee falls to 70 in another year, no worries, the returns from FD more than compensates for the currency depreciation.

LikeLike

The unhedged FCNR exposure was 10 billion USD so a fall of 6 Billion USD in reserves is not out of the ordinary. Rupee was at 58, 2.5 years back against the USD so even accounting for the interest earnings is at best at par and even against SGD it has fallen from around 46 to 48 in past year or so.

A strong currency is one that’s stable and Rupee has had its share of volatility just like any other currency.

LikeLike

Amazed by the strength of the rupee. FCNR issue is over now. RBI reserves too are rock solid. Now no fear about rupee falling.

LikeLike

India’s foreign reserves have fallen by around 6 Billion USD since 30 Sep and the Rupee has hovering around 68.50, I don’t know what makes you think it’s strong?

LikeLike

Just recieved the money into my NRE account that I had initiated from Money2India using Indicative rate. The rate I got is 47.84. This is also the indicative rate that ICICI money2india website is displaying. DBS on the other hand is displaying 47.77.

So it is established that now Money2India is no longer the underdog in terms of rates, like it used to be.

LikeLike

I hope its not just a short term marketing ploy to bait and switch customers. Hope they continue giving the best rates in months to come. Higher the competition the better it is for us consumers

LikeLike

Money2india is back to its old ways… Dbs, SBI and Hdfc all have better rates.

LikeLike

Nope Money2India is giving 47.62 at the moment. DBS is giving 47.48.

LikeLike

It’s confirmed that money to India is back to its old ways or does not update rates very often… Current DBS rate 46.95, money2india 46.80

LikeLike

@Aditya, May be you are right, about the money2india rate. But I would like to confirm tomorrow real time during trading hours.

LikeLike

From what I have observed the money2india rates update twice a day, around 12:00 noon and around 9pm Singapore time . So if SGD INR is falling money2india could give a better rate purely on the account that it doesn’t update as frequently

LikeLike

Hi Aditya,

I have transferred money from my NRE Account to my relative as he was in need of money through RTGS, but now when he wants to return my money via same RTGS to my NRE account is not possible as they will not accept transfer in INR. So my question is how can retrieve that money from him ? Can I ask him to do RTGS into my savings account.

Is my money become illegal (black) ?

Thanks & Regards

Arin

LikeLike

You can transfer money from NRE to NRO/resident account but not the other way around. You can ask your relative to transfer it to your NRO account. If you dont have NRO then to your resident account. It is not black money. However, the interest earned on money in resident/NRO account is taxable so there will be TDS cut. In case you want this refund from the tax dept, since your taxable income in India is below the limit, then you can claim the refund when you file your returns. So, no problem, ask your relative to transfer it to your NRO/Resident account.

If you intend to transfer this to NRE inorder to open NRE FD, then there is process. You need to ask your CA to prove the source and upload a particular form on the Income tax website and then you can do it. But if you dont need to open NRE FD, then its not necessary.

Ideally you shouldn’t keep resident savings account. Inform your bank to convert it to NRO. It can be done easily.

LikeLike

http://www.bloomberg.com/news/articles/2016-11-24/three-charts-to-show-why-ghosts-of-2013-won-t-haunt-indian-rupee

“In the days of anti-globalization rhetoric, the countries with a strong domestic market will be preferred over trade-oriented countries,” said Kim Jinha, Seoul-based head of global fixed income at Mirae Asset Global Investments Co.

Hint at Singapore, eh? 🙂

LikeLike

Morgan Stanley lists SGD/INR as top short for 2017

http://www.businessinsider.com/heres-morgan-stanleys-top-fx-trades-for-2017-2016-11?IR=T&r=UK&IR=T

I am not optimistic on INR, but then I am also not very optimistic on SGD. Its over dependence on China will put pressure on it.

LikeLike

Didn’t Morgan Stanley make the same call earlier this year?

Anyway I would take what they say with a huge bag of salt…here is report that shows them quoting 73 for INR against USD by the year end

https://www.google.com.sg/amp/www.livemint.com/Money/HZVxX3BEQxCYTI9qPGBF3L/Morgan-Stanley-sees-worse-coming-for-rupee-Asias-biggest-l.html%3ffacet=amp&utm_source=googleamp&utm_medium=referral&utm_campaign=googleamp

LikeLike

I believe SCB is similar to DBS in that you need an account with them to make remittance to India. Unfortunately I have only OCBC account. So I will just use money2india to transfer. I see now that money2india rates seem to have improved and match DBS. I guess I will transfer the 20K SGD that I have with me now. Nice chunk of 10L INR to create an NRE FD. SBI has cut bulk deposit rates(above 1Cr) to 4.25% now! FD rates for retail too could fall further.

LikeLike

Hi,

Pls check this. Look for best forex rate guarantee.

https://www.sc.com/sg/ways-to-bank/scremit/?gclid=CP_fvtiNy9ACFdGKaAodqjgFLQ&gclsrc=aw.ds&dclid=CJX6g9mNy9ACFdeSjwodhJAL5w

LikeLike

Thanks. Based on the current rate they are offering same rate a SBI. Given they are not transparent like DBS and SBI with their exchange rates (rates updated every 15 minutes) I would take their best rate guarantee with a pinch of salt.

LikeLike

I transferred today. Rate was better than DBS at that time..

LikeLike

Hi guys.. today rates are good.. Standard chartered offers a better exchnage rate compared to DBS.

Thanks

LikeLike

Where can one check the Standard Chartered rates online?

LikeLike

I just noticed, money2india spread has improved compared to SBI and DBS. In the past money2india always had the worst spread. I guess, there must have been a change in their strategy. Anyways, I have a feeling INR could come crashing down very soon due to the badly managed demonetization. I am hoarding SGD for now. Already accumulated 20K so far. But not sure whether to keep it in OCBC 360 account earning 1.7% PA, as I only use the salary credit and 3 bills payment features. Or should I consider some global debt funds. There is a chance that once the US rate cut happens yields will fall as rates are expected to rise only gradually.

LikeLike

It could be a one off thing where money2india has not updated the rates. The RBI was active in market today and jawboned traders to not take positions against the Rupee and also aggressively sold dollars in the open market. The Rupee should ideally cross 70 and is extremely overvalued against a steadily declining Yuan. Ofcourse govt will not let Rupee cross 70 as opposition will get another opportunity to lambast the ruling party. Sgd on the other hand has everything priced in and as Rupee slowly depreciates sgd INR rate will edge back up.

Bank Of China offers excellent returns of upto 3.55% and that is my choice for keeping money

LikeLike

Hi Aditya,

Do you see SGD/INR touching 48 again in the near future.

Thanks,

Amay

LikeLike

Hi Amay,

SGD INR is already around the 48 mark this morning (47.97 as I write) and I expect it to cross 48 today itself.

LikeLike

Sgd INR trades at 48.10 as of now and INR has crossed 68 against USD.

LikeLike

Bloomberg also agrees with me 🙂

http://www.bloomberg.com/news/articles/2016-10-27/big-daddy-holds-sway-over-india-currency-market-as-traders-gripe

“For investors, the lack of currency swings has meant that borrowing in dollars to purchase rupee assets earned 15 percent in the past three years, the highest in Asia, data compiled by Bloomberg show. Buying the Indonesian rupiah delivered a 4.6 percent return.”

LikeLike

Bloombergs analysis hold true only if someone converted Rupee 3 years back and is nothing but twisting data to make a news piece. A true analysis would be a time series of converting money to INR every month since Aug 2013, factoring in all the costs of conversion etc and then comparing.

If Bloomberg took June or July of 2014 as reference Rupee has slumped big time, from 58 against the USD to 67 now – it’s a matter of correct perspective 🙂

LikeLike

Nice post Aditya,

However, you forgot to take into account, the risk free rates between USD and INR while calculating the returns. So answer to your title question: INR has been a real star 🙂

LikeLike

Well depending on where one invested INR might be just at par. Those who invested in mid 2014 even in NRE FD when usd INR was 58 would still be out of money. So star or not would be very contextual.

LikeLike