As an NRI, you would have wondered many times, what parts of your Indian Income are taxable and what are not and trust me you are not alone.

Under the Indian Income tax act, the tax rates, deductions from income, exemptions from taxation all change depending on the nature of income and residential status of the individual. With the ever changing tax provisions, even if you searched online the chances of finding the information you are looking for would not be easy and filtering out the tax provisions that are applicable to an NRI is even more difficult.

Not being able to find consolidated tax provisions on common investments used by NRI’s I decided to compile the information myself and hope that fellow NRI’s will find it useful.

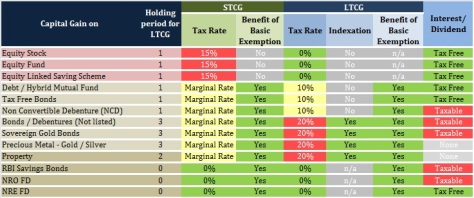

NRI’s mostly invest in Fixed Deposits, Bonds, Mutual Funds, Stock and Property which would generally give rise to income under Capital Gains or Other Income (Bank Interest or Dividends) under the Indian Tax laws.

I have tabulated the provisions that an NRI should be aware of for FY 2017-2018 (click on table to open in new window)

One of the most interesting things to note is that the basic tax free exemption is not available to an NRI on Equity Investments. What that means is that if an NRI gained 2,50,000 Rupee by investing in stock market the whole 2,50,000 Rupee is taxable. If these gains are long term (asset held for more than 1 year) then there is no tax liability but for short term gains the tax rate is @ 15%. So an NRI would pay Rs.37,500 in taxes, the income would not attract any tax in hands of a resident Indian.

Another interesting fact to note is that the gains on redemption of Sovereign Gold Bonds are not chargeable to tax if held till maturity.

With difference in tax rules being different in different countries an investor should consider the tax domicile of the investment to maximise returns. In Singapore and Hong Kong the Capital gains, Bank Interest and Dividends are not taxable, however in USA and UK these income are taxable.

For example if an NRI bought a mutual fund in India that returned 20% over a period of 6 months then his gains would be taxed at a flat rate of 15% resulting in a post tax return of 17%. Buying this same fund in Singapore would have been as the gains are tax free and the investor pays no tax.

Similarly for bonds the interest is taxable in India and taxed at the marginal rate based on your income bracket but tax free in Singapore and Hong Kong.

E.g . An NRI whose total income is over Rs. 10 lac (30% tax bracket) buys a bond that pays 9% interest p.a. The post tax yield of this investment would be 6.3% . Add to it the cost of transferring funds to India of around 0.8%, the yield drops to 5.5%. If the plan is to remit the money back to Singapore on maturity, which will cost another 1%, the investment would yield 4.5% only.

These are just 2 examples to get you thinking. There innumerable scenarios that I can come up with based on different countries of residence and each individuals tax profile. All I would like to highlight is that an investor should not underestimate the impact of taxation and ancillary costs while making investment decisions and look at all aspects before making an investment decision.

Watch out for an investment comparison tool that I am working and will post it here very soon. Till then keep reading and sharing.

Hi Aditya – In relation to RNOR status I have a few queries which would be helpful if I can get some information: I was outside India from 21-March-2008 to 26-June-2018 with pure NRI status (total 115 days in India during this period). Returned India on 26-June-2018 and till date didn’t go back.

Questions are :

1. When will I lose the RNOR status?

2. While in RNOR status can I keep my NRE FDs and can open new NRE FDs?

3. Let’s say I lose RNOR status on 20-June-21 and the NRE fixed deposit maturing on 20-Dec-21, so tax will be based on slab from 20-June-21 onwards?

4. I am still holding Singapore PR and have a retirement account overseas which can’t be closed until it loses the PR status in 2022. So, when I receive funds from the retirement account in 2022 will that be taxed? Note: all these earnings were during my NRI status.

5. Can I open an FCNR FD account for 5 years while he is RNOR? If yes will the interest be taxed on maturity? Basically is there any benefit of opening FCNR FD for me?

Appreciate your time and inputs to these queries. Thanks.

LikeLike

Hi Deep

Those are a lot of questions and best would be to engage a chartered accountant to help you take comprehensive decision. Indian tax laws change every year and I have not had the time to look check if any changes were made this year. There was a provision to have people become resident with 3 months of stay vs 6 but then again new notifications came out due to pandemic.

Based on previous rules you will loose RNOR status next year in June as you correctly calculated.

I don’t think you can open NRE or FCNR account with RNOR status. You can continue to hold the ones you have. You should check with your bank on the rules to convert to RFC account.

Technically, your interest income on cpf account should be charged in India now that you are RNOR. Capital remittance of cpf would be tax free as it’s just like any other saving.

Hope that helps.

LikeLike

hi Aditya, just wanted to check if the investment comparison tool you had mentioned earlier is posted somewhere? 🙂

Also re the above table, isn’t tit true that for equity stock investments, even for a LTCG there’s a 10% tax for NRIs?

LikeLike

Hi Aadi,

You can use the widget at https://adityaladia.com/2017/07/18/widget-widget-on-the-wall-which-is-the-best-investment-of-all/

LikeLike

Hi Aadi,

You can use the widget at https://adityaladia.com/2017/07/18/widget-widget-on-the-wall-which-is-the-best-investment-of-all/

And the LTCG depends on the instrument type… Equities are exempt

LikeLike

I read that SGD INR can depreciate to 75 from 51 by Y2025. What is your view

LikeLike

Well, it could also appreciate to 40 by 2025. Simply speaking, these kind of news snippets are written to attract readers and based on lots of assumptions. The risk on SGD weakening is equally high if the ruling party looses some seats in the un-announced elections

LikeLike

Hi Aditya,

As you mentioned that tax rate for NRO FD is 0%, however as I know it is 30.9% for interest earned in NRO FD / NRO account. Did you mean to avail DTAA benefit on NRO account?

Thanks

Deep

LikeLike

Hi Deep,

There is no short term or long term capital gains on fixed deposits however interest is taxable at the marginal rate (refer the last column) in the table.

Thanks.

LikeLike

Thanks Aditya, got your point.

I am a resident tax payer in Singapore, so please can you help to clarify if I am eligible to avail tax exemption on NRO deposits under DTAA process?

Details from ICICI I got as follows : You can avail DTAA benefit on your NRO accounts by providing a self-declaration in the prescribed format, self attested PAN card copy, Form 10F and tax residency certificate for the current year. https://www.icicibank.com/managed-assets/docs/nri/DTAA-Notice.pdf .

Regards,

Deep.

LikeLike

Hi Deep,

DTAA does not make any difference to you for NRO interest when you are tax resident in Singapore.

Indian income is not taxable in Singapore for you and nor is Singapore income taxable in India.

On the interest on your NRO account the bank will withhold 30% tax which you can claim back while filing your returns.

Hope that helps.

Cheers

LikeLike

Hi Aditya – Thanks for this clarification.

Regards,

Deepak

LikeLike

Hi Aditya,

Whats your view on SGDINR rate in near future. What can be good option to invest money in India for fixed return – FD, Bonds, FCNR etc. Lastly have you completed your investment comparison tool.

LikeLike

Hi Piyush,

I prefer NRE FD and RBI Bonds for fixed returns.

Have been very busy at work and have not had the time to work on the tool. Hopefully can be done in the next few weeks.

Thanks.

LikeLike

Thanks. What is the preferred route of purchasing RBI bonds ? Any view on SGDINR

LikeLike

You can buy RBI Bonds through your regular demat account or broker. These bonds are taxable. SGD INR will stay around 47 for next month or so with 2 factors impacting the direction – possible interest rate cut by RBI and war.

LikeLike

Hi Mr. Aditya, a follow-up question please. I understand the Singapore CPF payouts will be taxable on receipt in Singapore, as long as I am a Singapore PR. Assuming no additional income in Singapore, the yearly CPF payout will be within the Zero tax slab. The question is tax in India as a “resident” in India (I will be a Singapore PR and Indian Tax resident concurrently)

LikeLike

Good Morning Mr. Rajan.

Yes, the cpf income in Singapore will be taxable in India under the category of overseas income / other income as you will be tax resident in India.

LikeLike

Aditya, I am 63, a Singapore PR and planning to relocate soon to India for retirement. Please can you provide your opinion on opting for Enhanced Retirement Sum (by transferring a sizeable amount of my savings / CPF Ordinary Account into my Retirement Account with CPF) for a steady monthly payout vs. investing the same amount in India in mutual funds, with tax etc. considered. What is your suggestion please?

LikeLike

Hi Mr. Sundar,

Taking the CPF brackets as 83,000 166,000 and 249,000 for Basic, Full and Enhanced Retirement Sum the pay out per month shown on CPF board website is 750, 1380 and 2000 sgd. The assumption is that the sum in the cpf account will run out by end of 20th year. The rate of return for the 3 options is 9.1% 7.9% and 7.5% all taxable on receipt in Singapore. If you are going to retire in India then these payments would be considered foreign income and subject to tax in India. However, you would be able to claim benefits under double taxation avoidance agreement between Singapore and India and reduce some tax liability.

I would have recommended investing in 15 year tax free bonds that were issued last year in India if you had asked this question last year. With a tax free interest of 7.65% the yield for these tax free bonds would have been much better than both leaving money with cpf or investing in mutual funds in India.

The decision on what could be a good portfolio for you would depend on your monthly cash flow needs and any other income to decide your taxes and liabilities.

Your tax residency status would also be a important consideration depending on how often would you traveling back to Singapore and how many months will you spent in either countries.

You could consider RBI bonds that give 8% interest as an alternative to bank deposits. Again I am assuming that you would no longer be able to enjoy benefits of a NRE account as you would become a tax resident in India.

In summary, without the complete picture it’s very difficult to suggest options that might work best for you.

Regards

LikeLike

Aditya, based on your statement “Buying this same fund in Singapore”, please suggest how can a NRI in SG buy the same funds “India based mutual fund houses” in SG.

LikeLike

Poddar, not all funds that are available in India are available in Singapore and definitely not directly through the same fund house. You can check out Fundsupermart or DBS/OCBC who have India specific funds and some of them perform even better than funds domiciled in India.

LikeLike