Travelling from Busan to Seoul on a train gives ample time to think about the question many of you have asked – Is it worthwhile to invest in FCNR deposits?

Instead of looking at purely FCNR deposits I decided to do a comparison between FCNR deposits and the good old NRE deposit.

The analysis did become a little tricky as the SGD FCNR deposits have ridiculously low-interest rates and there is no SGD INR forward cover that is readily available in the market and I had to use USD for comparisons.

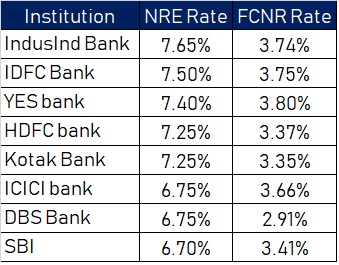

First of all, lets look at the NRE and FCNR deposit rates on offer in the market for a one year period.

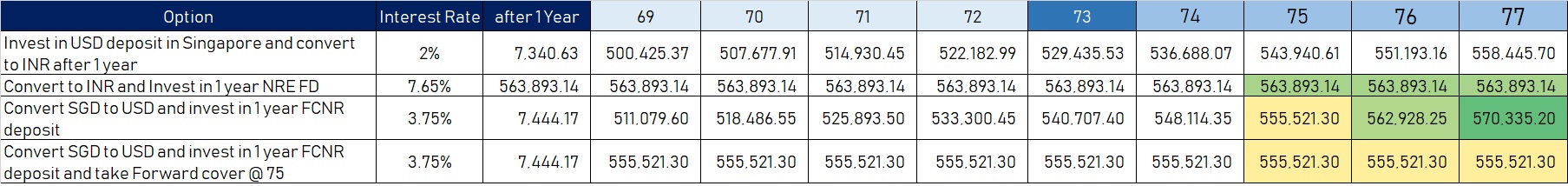

Using the best available rates for both NRE Fixed deposit and FCNR deposits we have the below payoff for a one year maturity and expected USD INR rates.

Depositing money in USD deposits in Singapore

This is probably the worst of all the options. The best possible rate for USD deposits in Singapore is 2% and banks charge anywhere between 0.5% to 0.7% to convert SGD to USD and back from USD to SGD. Though one would often see the advert say that there are no charges but the cost is built-in the exchange rate. With the cost of converting money the yield turns out to be mere 0.5%. So unless you are expecting a massive Singapore dollar weakness against the USD this option is best avoided. It is better to keep your money in BOC Smart saver account for better yields.

Investing in USD FCNR with a one year forward cover

The costs involved here are 0.7% to convert SGD to USD, cable charges of atleast 30S$ to transfer money to FCNR account, cost of a forward cover in terms of margin money and brokerage and finally the cost of converting USD back to INR or to SGD and remitting back to Singapore.

With all the associated costs, this option would work if you expect the INR to strengthen back and want to lock the exchange rate at current forward rate of 75. Here the interest on FCNR deposit is tax free but the gains or losses on the forward cover will attract taxes and on the pay off matrix it is not a great option.

Investing in NRE FD

The cost here is simply one time money of 0.5% to transfer money to NRE account and cost to transfer money back if one so desires.

This option gives the stable returns without any complicated transaction setup.

Investing in USD FCNR deposit without a forward cover

The costs here, as in option 2 above, are 0.7% to convert SGD to USD, cable charges of $30 to transfer money to FCNR account and the cost of converting USD back to INR or to SGD and remitting back to Singapore.

Depending upon one’s outlook for USD INR this option can give good returns. If Usd INR crosses 76 over the next year then this option gives better returns than NRE FD but if INR strengthens then one might lose any gains made from interest income.

So what is the recommendation?

Given the increased uncertainty in global markets predicting the USD INR rate 1 year rate is nothing short of speculation. I personally do not think the USD INR will cross 77 or even if it crosses will stay at that level at the end of one year. To do the FCNR deposit for a very, very small gain over NRE deposit in the event USD INR crosses 76 does not look great from the risk reward perspective but if you really want to try then put half your money in NRE FD and the other half in USD FCNR deposits.

KBL is offering SGD FCNR @ 3.32% for 5Y (at the time of writing)

https://karnatakabank.com/personal/term-deposits/interest-rates

IMO its the best that a parking fund can get.

LikeLiked by 1 person

As per the link it is less than 1%. Can you please check again?

LikeLike

Oops, realized it is 2 yr old post. sorry.

LikeLike

TMB offers 4.57 % on a 4 year USD FCNR. I think that is a good option to consider. What is your opinion on this?

LikeLike

A fair comparison then would be against the IDFC NRE fd that will fetch 8.25% pa, the payoff will be in favor of FCNR if the USD INR rate stays at or higher than 76 (same as 1year pay off) after a 4 year period. I think that in the long term indian economy will do better than US economy and rupee should oscillate around the 75 mark.

If you do want to invest in FCNR then wait for 3 months, let federal reserve do one more rate hike or RBI to be forced to come up with another FCNR scheme due to market pressures.

And yes, do consider the fiscal strength of the bank before making investments. FCNR deposits are not secured /guaranteed by RBI and TMB is not the strongest bank out there.

LikeLike

Hi Aditya,

Thank you for your prompt response. City Union Bank does offer RFS deposits in SGD. The interest rates are 2.79%; 2.94% and 3.04% for 1, 2 and 3 years respectively.

Thanks.

LikeLike

Hi Rajan,

Given that you have deposits maturing in SGD investing in SGD RFC would save the conversion cost. SGD tends to move inline with USD and with comparable interest rates the yield should be more or less the same.

Thanks

LikeLike

Hi, I have a question: I returned to India for good this January. I have some SGD FCNR’s maturing next month, which I want to park in RFC deposits for the next 2 to 3 years. Which is a better option : convert the SGD maturity proceeds to USD and hold as RFC-USD deposits OR hold them as SGD-RFC deposits for the same period? Regards, Rajan Sundar

LikeLike

Hi Rajan. I don’t think you can open SGD RFC deposit. Atleast I don’t know of a bank that offers RFC in SGD and even if they did the interest would be very low. So I prefer USD RFC deposits.

Thanks

LikeLike