NRE FD has been my preferred low risk, tax free investment option since the time RBI allowed banks to offer interest rates of their choice. However, with the established banks offering only 5% or lesser rates on NRE FD’s, I have been looking for other options that can give higher returns but with same low risk.

A few banks like IndusInd still offer 6.5% rate on NRE FD but with bank deposits being insured only upto 500,000 rupees the risk of loosing money in case of a default goes up (do remember what happened to Yes Bank and other co-operative banks). A bank will only offer interest rate higher than the market rate under 2 scenarios – either they are a new player and want to build a customer base or they are unable to raise funds easily as markets believe their business to be risky.

Bharat Bond ETF is one such instrument that has been on my radar and I wanted to analyse how it stacks against the NRE FD.

What is Bharat Bond ETF?

Its a Fixed Maturity ETF that invests in AAA rated bonds of Public Sector Companies (PSU). These bonds are not the same a Government Bonds (G-Sec’s) but pretty close in terms of risk profile given that govt has majority stake in most PSU’s.

As this is an ETF, an investor can sell the investment anytime on the National Stock Exchange (NSE), thus being extremely liquid. Yes, there would be short term or long term capital gains depending upon the date of sale but calculations suggest that its a good investment even with taxes if held to maturity.

How does it compare to NRE FD?

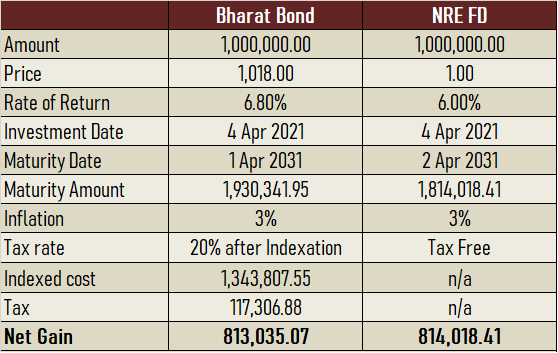

BHARAT Bond ETF wins hands down even after providing for tax when compared to NRE FD’s from large banks.

For calculations, I have assumed that the investor holds the etf to maturity and inflation averages 3%.

The break even interest differential between the two investments is appx 0.8% with the above assumptions of maturity and inflation. What that means is, in theory, if Bharat Bond ETF yields 6.8% then an NRE FD of 6% will provide roughly the same total return.

Why is Bharat Bond ETF better than NRE FD?

One has to consider multiple factors when considering an investment and not just the yield. The most important factor would be liquidity, default risk and tax impact if you return to India. Bharat Bond ETF provides better risk protection on amounts greater than 500,000 when compared to NRE FD and more liquidity as it is traded on exchange.

Bharat Bond ETF is a better investment than NRE FD irrespective of the interest rate if you have plans to return to India over next 8 years (the tax free benefit of an NRE account ceases within 2 years of returning to India) as the interest from deposits will no longer be tax free. The sooner your plans to return to India the greater the gains from ETF would be when compared to NRE FD.

Inflation protection is the other benefit that the ETF provides – If the inflation increases and averages to say 5%, the indexation benefit will reduce the tax liability as shown in table below

Similarly, if the capital gains are removed or the tax rate is reduced in the future the gains from the ETF will be higher.

So no matter how I look at it, Bharat Bond ETF maturing in 2031 is a better investment as compared to NRE FD for long term wealth accumulation. Instead of opening a fixed deposit buying this ETF makes a lot more sense for all investors whether non resident or resident.

I think the fixed deposit rates in India are set to peak at 8.5% for tier 2 banks. What does everyone else think?

LikeLike

I think FD rates have already peaked, unless there is an inflation upside surprise and RBI starts hiking rates aggressively. But if FD rates hit 8.5%, I would imagine Nifty will tank 10-20% in this scenario so there will be better opportunities there. I could be completely wrong though.

LikeLike

Tier 1 banks are at 7%, gsecs are 7.4% and bharat bond ETF 7.5%. Should investors not just invest in gsecs directly to have better yield then? and to attract funds the banks will need to offer better rates and that makes me think there is room for some more upside

LikeLike

You have a good point. I believe by Tier 1 you mean Axis bank which seems to have reached 7%. Tier 2 is Indus Ind bank which still hasn’t revised it’s rate from 7%. It will be interesting to see which will be the 1st bank to offer 8% rate.

LikeLike

Hdfc is 7% as well and yes I am looking at IndusInd, IDFC etc which are now at 7.5% but only offering 2-3year term.

LikeLiked by 1 person

Power Grid Invest IT IPO offers yields upto 8% and would be comparable to Bharat bond etf. The issue closes tomorrow and could be a good way to diversify fixed income portfolio

LikeLiked by 1 person

Interesting, but I guess we would need a demat account?

LikeLiked by 1 person

Probably. Similar to bharat bond etf I think

LikeLiked by 2 people

BTW, there is another bond fund called Nippon Nivesh lakshya, this is a 25yr maturity GSEC fund. If you want to lock in the current yield fo 25yr duration, if you feel yields will be lower and lower, then this is a great instrument.

LikeLiked by 2 people

What’s the YTM for this fund?

LikeLike

It is 6.84%

LikeLike

Thanks for sharing Nitin. That’s pretty close to the Bharat Bond ETF and with low management fee it’s a good bet. Might be better than those endowment or pension plans insurance companies offer.

LikeLike

Nice post. I agree, it makes sense to lock in to Bharat bond 2031, at these juicy yields especially people planning to return back to India. But even if you are not returning back, over a 3 year horizon the Bharat bond returns after tax should be better than NRE FD, unless FD rates go up to 7%, which is unlikely, in my opinion.

So my plan is also to slowly diversify into Bharat bond from my NRE FDs.

LikeLike

Better still if the price falls a little bit, below 1010 it is an even better investment

LikeLike

The yield seems to have not budged and is holding at 6.8%, I would not be surprised if some institutional money is moving into this ETF.

LikeLiked by 2 people

You mention ” the tax free benefit of an NRE account ceases within 2 years of returning to India as the interest from deposits will no longer be tax free” . The fact however is that the NRE Rupee account ands the NRE FD have to be converted into “resident” Rupee and FD accounts within a reasonable time (not specified, may be 3 months?) of returning to India for good at the same contracted rate of interest and maturity date. Upon conversion thus to “resident” accounts, The interest from such FDs will attract income tax in India. The FCNR deposits can however continue till maturity. One has the option of depositing the funds from NRE savings and FD accounts in RFC account (and could enjoy tax free interest as long as one has the RNOR status (2 or 3 years after return to India)

LikeLike

Well you have just re-iterated my point, the crux here is tax free interest, whether it comes via NRE account or RNOR account is irrelevant.

LikeLike

My point is that interest from NRE FDs will become taxable upon return to India for good (and not ” …within 2 years of returning to India”, as you have stated)

LikeLike

The within 2 years refers to the RNOR status. No one becomes ordinary tax resident in India immediately upon return. Depending upon the date of return and previous years one has stayed out of India tax residency will change and so would the treatment of NRE account income. Note the words are “…. within…” and not after 2 years

LikeLike