Its been time since the last post on SGD/INR and a lot has happened in the currency market. Though surprisingly the SGD/INR rate has moved in the narrow range of 32.5 – 33.50.

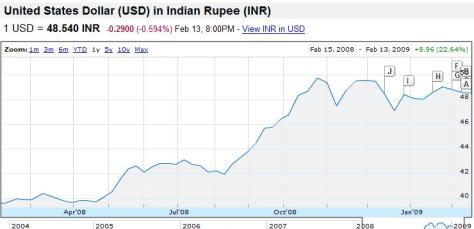

The past few months saw SGD strenthening from 1.55 to 1.44 against the US dollar. Rupee on the other hand moved from 52.5 to 48.00 against the greenback.

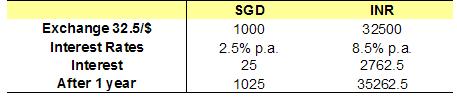

The interest rates front has turned interesting as well – the central banks are not so focused on inflation and growth seems to have caught their attention once again. The rates have softened across geographies. The Interest rate in singapore for a long term deposit will average around 1.25% and India a long term deposit brings in 7% on an average (though the long term National Savings certificates still get 8% but the lock in is for 5 years)

In the light of the new data converting singapore dollars to Indian Rupees still makes sense.

Even if the Singapore dollar stays at 32.75 agaist the Rupee the gain turns out to the 5.6% and a chance of loss is only if the Rupee weakens beyond 34.60 against the SGD.

As earlier thats a unlikely scenario. The probability of Rupee strenthening against the USD to the range of 44 – 46 is extremely likely and that would see SGD INR heading down to Rs.30 levels. When will that happen is really difficult to say, but for the time being it still makes a lot of sense to convert SGD to INR (those of you who followed the post in the past must already be sitting on annualilsed gains of 5.6%).

If you want to go a step further then borrow in Singapore dollars – a lot of banks are running offers for 6 month loans for a effective rate of 3% p.a – and convert to INR.

Even with the interest lay out you stand to make near riskless gains of upto 3% or more!!