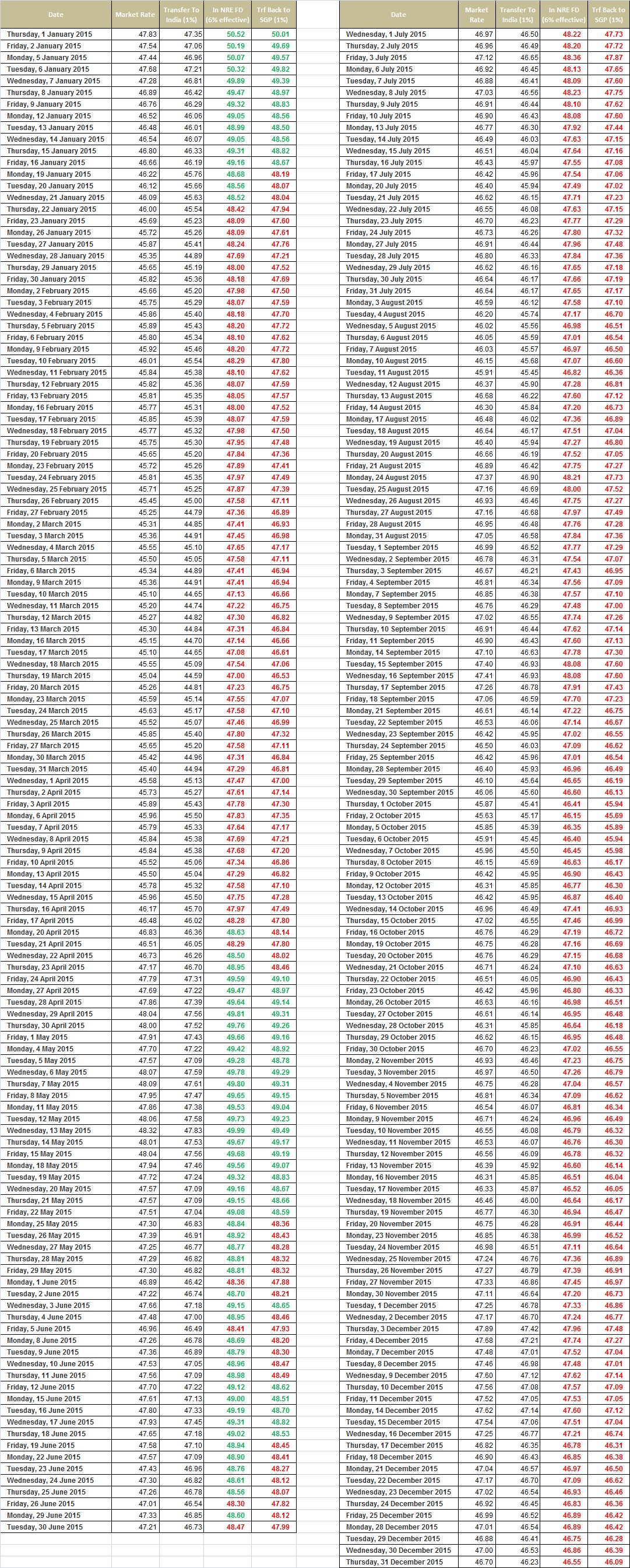

SGD INR finally crossed 55 after appreciating 5% from the exchange rate in Nov 2019 – 52.60. Theoretically speaking you would have gained slightly more by transferring to India but after accounting for the transaction costs it might not have been much.

It stayed below the 55 mark as I had written more than 2 years back SGD INR flirts with 52 could it hit 55. That time i did not think it will cross 55 but now I am updating my SGD INR target to 57, yes you read it right, Fifty Seven!!

By when?

I expect this to be achieved by the end of the year and then the rate should slowly decline back to 54.5 leading upto the Indian Budget in Feb 2021

The rationale being that USD INR will touch 76.5 and USD SGD will move to 1.34 mark in the short run.

Why will INR weaken?

Inflation and rising COVID cases will make it hard for INR to appreciate, the fund flows on account of mega deals that Reliance Industries has been doing should come to an end and at some point the Foreign Institutional investors will book profits and withdraw their gains from the stock markets. RBI will smoothen then currency movements but given the inflation has very little room to tweak the interest rates.

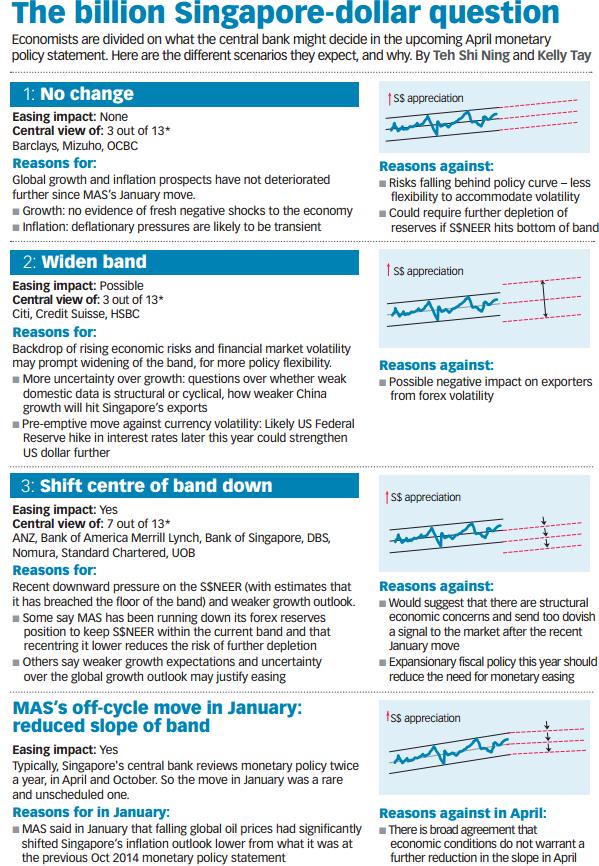

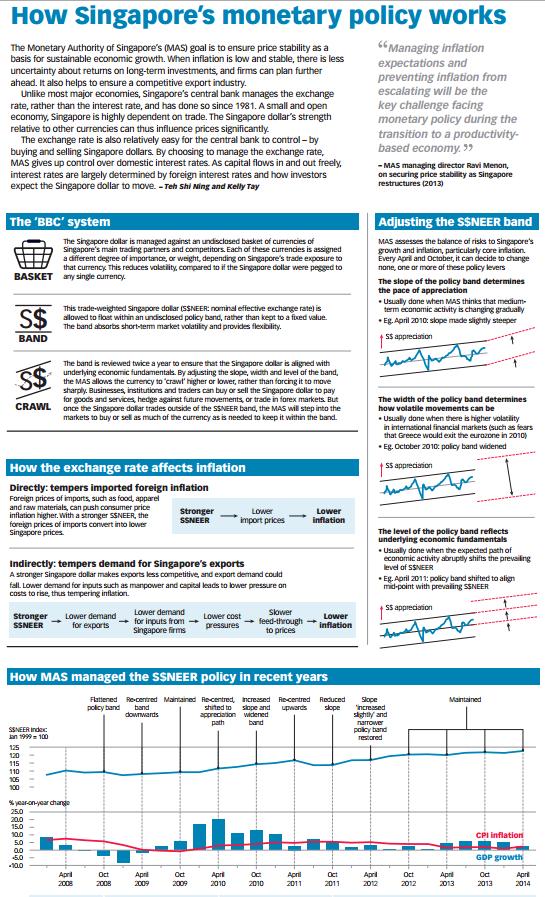

Why would SGD strengthen?

Singapore is one of the last few countries that offer a positive interest rates on government securities and is politically stable unlike US or parts of Europe. This gives SGD bonds safe haven status and money comes in. The same thing happened in 2009-2012 when SGD rose to as high as 1.22 against the USD.

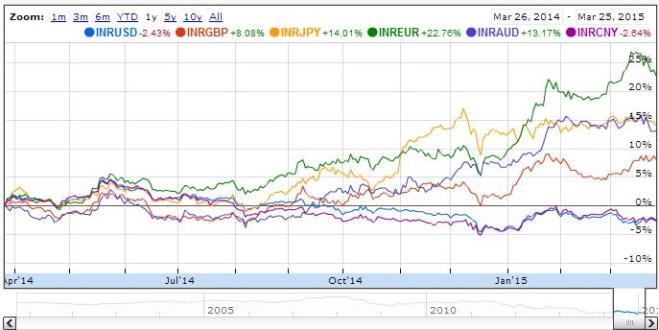

Does this only benefit SGD INR?

Next 6 weeks should provide opportunity across currencies – EUR INR could see 90, GBP INR 99 and USD INR – 76.5. So those looking to transfer can watch out for these levels.

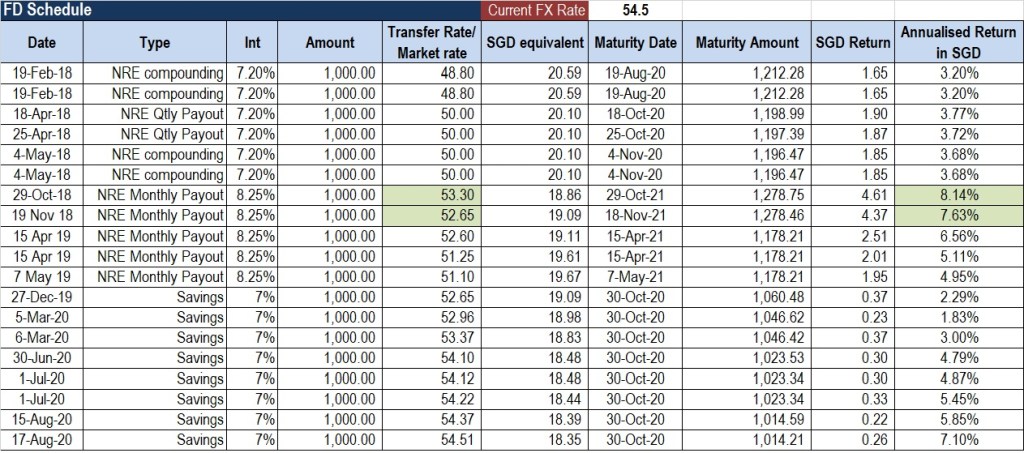

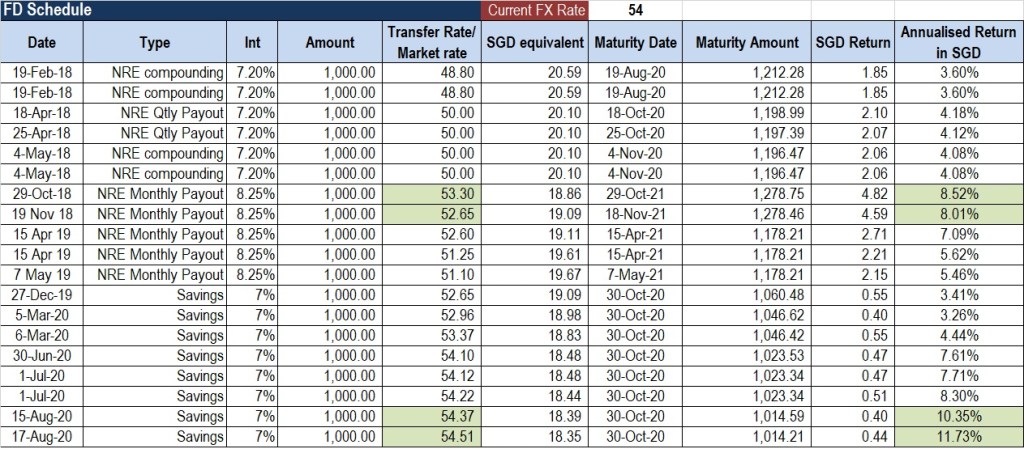

Instead of waiting for absolute levels, I would plan for any transfers based on what is your end goal. If you are getting a high interest rate in NRE FD’s or other investments now then even current rate of 55.4 is a good rate. Each of us have different goals, tax status and risk tolerances. Therefore plan based on your needs and not get stuck at specific levels.

There are other options if you do not want to transfer the money to India and yet want to gain with the short term increase in rates, watch out for the next post.