It’s a very interesting phenomenon every time SGD INR falls – people panic and there is a flurry of questions on SGD INR’s future. To me this anxiety is similar to a house owner checking on the market rate of the house they live, every week, and feeling sad if the latest transacted price in the neighborhood went down or celebrating if it goes up. In reality, this is just perceived loss/profit and is irrelevant unless the person is trading in properties and regularly buys and sells them for a living.

Anyway, leaving perceptions aside, lets look at how Indian Rupee has really performed against major currencies in the past 3 years before I turn my focus to SGD INR.

The Rupee has fallen against USD and JPY, against Chinese Yuan and Singapore Dollar its a flatline and the gains against EUR and GBP are not because Rupee has fundamental strength against them but because the 2 currencies have weakened due to their own issue – ECB monetary stimulus and Brexit vote respectively.

Also worth highlighting is Rupee’s inherent volatility where it went from 68/69 against the US dollar in Aug 2013 to 58 around Election time in 2014 and is back up at 67 mark – all in a matter of 3 years (refer comparative 1, 2 and 3 year charts at the end)

There is no doubt that the Rupee has been pretty stable in the past few months and the RBI has done a fantastic job of curbing the volatility in the face of BREXIT, expected US fed rate rise, Increasing Oil Prices,Redemption of FCNR deposits and escalating tensions with Pakistan.

But have the rupee or economic fundamentals changed to much in past few months? -I don’t think so.

India still imports 80% of its crude oil and as oil prices go up they would put a strain on the current account, the goods manufactured in China are still way competitive both in terms of cost and quality (maybe that’s why rupee is following the Yuan trajectory) and the NPA situation with Indian banks is still worrisome and could result in market turmoil.

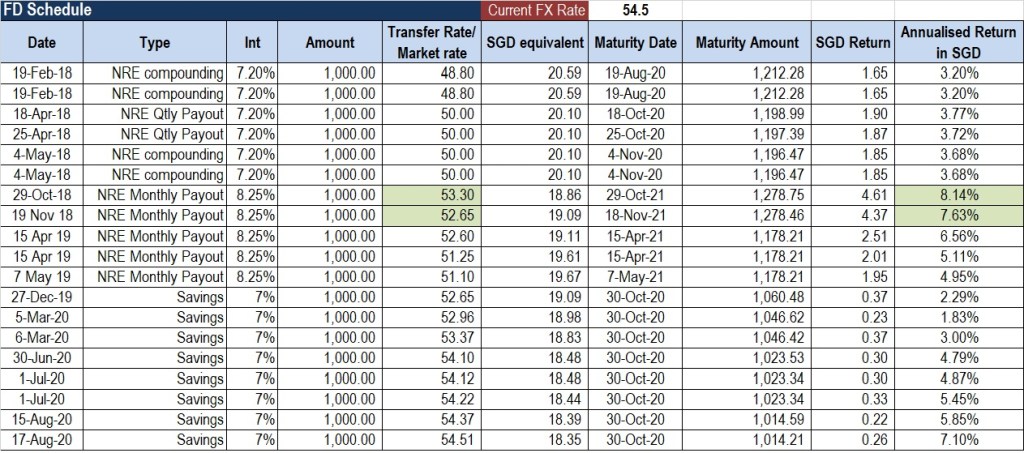

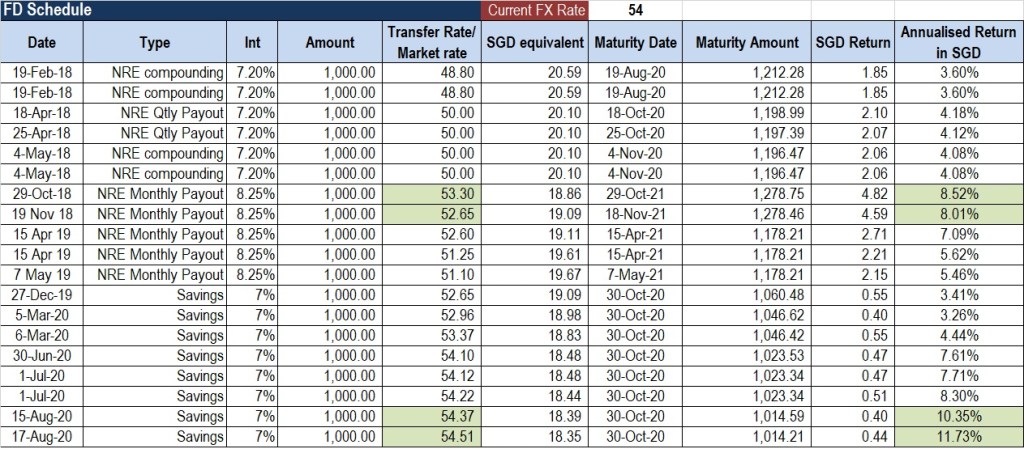

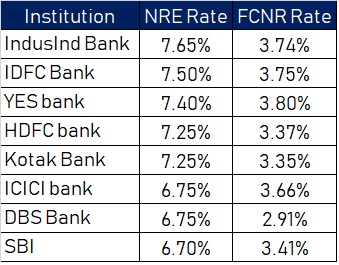

Investing in NRE FD’s has generated stable returns depending on when one invested, refer – (https://adityaladia.com/2016/02/11/you-would-be-out-of-money-80-of-days-if-you-transferred-money-to-india-in-2015/) and would slowly stop being an attractive avenue as the interest rates in India go down.

Now coming to SGD INR, the current weakness is mostly due to flurry of bad news (or expectation management as I call it) on the economic and employment front. I have always maintained that the MAS is pro-active and lets the SGD adjust quicker to the market events as compared to what RBI allows or can allow with the INR.

All the expected or known negatives are already priced into Singapore Dollar and any other movement would be due to fed rate decisions. Even after the news of GDP missing estimates the SGD only fell around 1% which is very normal in the current volatile markets.

On the other hand there are a lots of factors for the Indian Rupee that needs to be priced in – merger of banks due to NPA’s, challenges for exports due to relatively strong rupee – China and other ASEAN countries, increase in crude oil prices, looming fed rate increase and of-course any escalation on the international borders with Pakistan.

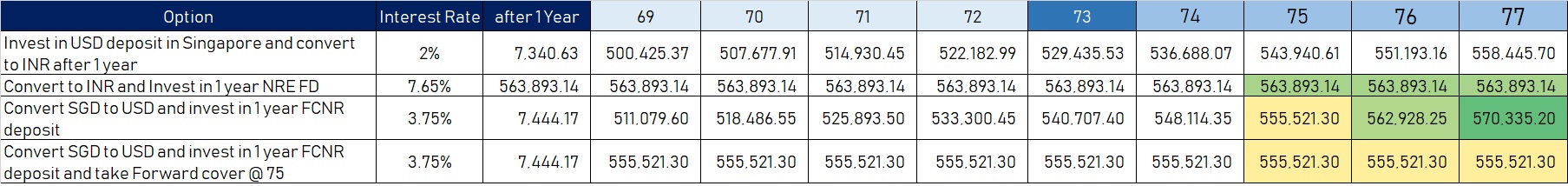

As with the answer to keeping money in Singapore Dollar or remitting to India, the response is unique to every individual depending on their investment portfolio, diversification, cash flows and risk appetite.

48 would act as a very strong support and do factor in the cost of transferring money into India and remitting back, the cost of loan (if you are taking one) and tax obligations if you invest in property or stock markets when making any such decisions and don’t get stuck on specific numbers – transferring money at 49.80 is just as good as transferring at 50.

————————————————————————–

INR performance – past 1 year

INR performance – past 2 year

INR performance – past 3 year