Travelling from Busan to Seoul on a train gives ample time to think about the question many of you have asked – Is it worthwhile to invest in FCNR deposits?

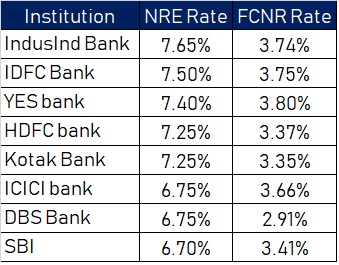

Instead of looking at purely FCNR deposits I decided to do a comparison between FCNR deposits and the good old NRE deposit.

The analysis did become a little tricky as the SGD FCNR deposits have ridiculously low-interest rates and there is no SGD INR forward cover that is readily available in the market and I had to use USD for comparisons.

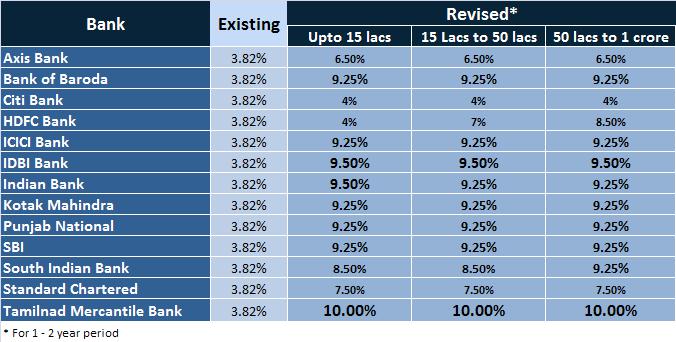

First of all, lets look at the NRE and FCNR deposit rates on offer in the market for a one year period.

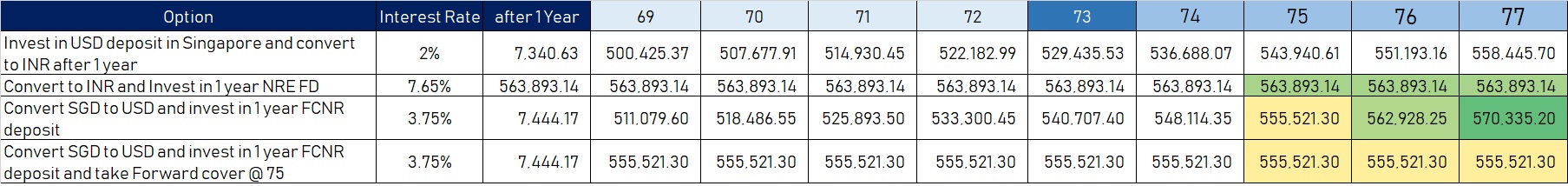

Using the best available rates for both NRE Fixed deposit and FCNR deposits we have the below payoff for a one year maturity and expected USD INR rates.

Depositing money in USD deposits in Singapore

This is probably the worst of all the options. The best possible rate for USD deposits in Singapore is 2% and banks charge anywhere between 0.5% to 0.7% to convert SGD to USD and back from USD to SGD. Though one would often see the advert say that there are no charges but the cost is built-in the exchange rate. With the cost of converting money the yield turns out to be mere 0.5%. So unless you are expecting a massive Singapore dollar weakness against the USD this option is best avoided. It is better to keep your money in BOC Smart saver account for better yields.

Investing in USD FCNR with a one year forward cover

The costs involved here are 0.7% to convert SGD to USD, cable charges of atleast 30S$ to transfer money to FCNR account, cost of a forward cover in terms of margin money and brokerage and finally the cost of converting USD back to INR or to SGD and remitting back to Singapore.

With all the associated costs, this option would work if you expect the INR to strengthen back and want to lock the exchange rate at current forward rate of 75. Here the interest on FCNR deposit is tax free but the gains or losses on the forward cover will attract taxes and on the pay off matrix it is not a great option.

Investing in NRE FD

The cost here is simply one time money of 0.5% to transfer money to NRE account and cost to transfer money back if one so desires.

This option gives the stable returns without any complicated transaction setup.

Investing in USD FCNR deposit without a forward cover

The costs here, as in option 2 above, are 0.7% to convert SGD to USD, cable charges of $30 to transfer money to FCNR account and the cost of converting USD back to INR or to SGD and remitting back to Singapore.

Depending upon one’s outlook for USD INR this option can give good returns. If Usd INR crosses 76 over the next year then this option gives better returns than NRE FD but if INR strengthens then one might lose any gains made from interest income.

So what is the recommendation?

Given the increased uncertainty in global markets predicting the USD INR rate 1 year rate is nothing short of speculation. I personally do not think the USD INR will cross 77 or even if it crosses will stay at that level at the end of one year. To do the FCNR deposit for a very, very small gain over NRE deposit in the event USD INR crosses 76 does not look great from the risk reward perspective but if you really want to try then put half your money in NRE FD and the other half in USD FCNR deposits.