Just yesterday, one of my friends mentioned going to universal studios and experiencing the rollercoasters and that reminded me of movements in SGD INR in the past few months. I said, you can experience a roller coaster just by trying to time remittances from from Singapore to India

Having started the year at 55.25 the pair saw lows of 53.80 by March and sharply reversed back to 55.75 in first week of April. That is a move of approximately 3% down and back up within 3 months which is unusual in the currency markets.

I had expected the pair to drop to 57 SGD INR 55 achieved, Target 57 last year but with RBI intervening in the forex markets and India’s better than expected figures of containing covid resulted in short term strength.

The rupee moved sharply lower after the RBI MPC meeting though there was nothing in the meeting that would warrant such a move. So what has caused such volatility in SGD INR?

Covid Connection?

With Covid cases rising sharply over the last month the fear of economic recovery being derailed is high. One could attribute this move to Covid – however, if you look at exchange rate in September 2020, when India experienced the peak of first wave, the exchange rate was between 53.5 – 54. So I don’t think its covid anymore at play here.

Correlation to Indian Bond yields?

Similarly the Indian G-sec Bond yields have fluctuated between 5.8 to 6.20% in the past three months and seem unlikely to have caused this move. Moreover, with a large borrowing agenda in 2021, RBI would do everything in its power to keep the yields stable / low thereby containing the cost of funding for the government. So I don’t think the expectation of increasing yields would have caused this move.

Falling Oil Prices?

Brent Crude traded close to 70$ in early march and has fallen back towards the 60$ mark in April. India imports almost 80% of its oil which is traded in USD. Having a strong rupee when oil prices are high and letting them fall a little as oil goes lower can help the cost of oil in rupees stable. I believe that this could be a small factor in RBI allowing the rupee to correctly sharply lower and I would watch the oil prices over the next few months to get a sense of where INR may be headed. However, I don’t think this was the real reason.

RBI reducing intervention in the forex markets?

This I believe is the real reason behind the rupees move lower. There was a very low risk carry trade in the market whereby an institution with access to dollar market would borrow in dollars and invest in rupee bonds thereby having an arbitrage of anywhere between 1-3%. The belief was that RBI would intervene and keep currency anchored around the 73 mark against the USD. RBI may have decided to purge such trades by either mopping up dollars temporarily or not intervening in the forex markets.

I am not saying that RBI is manipulating the currency but tri agenda of subtly boosting exports, lower oil prices cushioning the cost of outflow and objective of flushing out traders with one way bets might have resulted in the sharp moves recently.

What to expect over next 3 months?

I think that 55 is now the new base rate with fluctuations of Rs 1.5 on both sides of the mean.

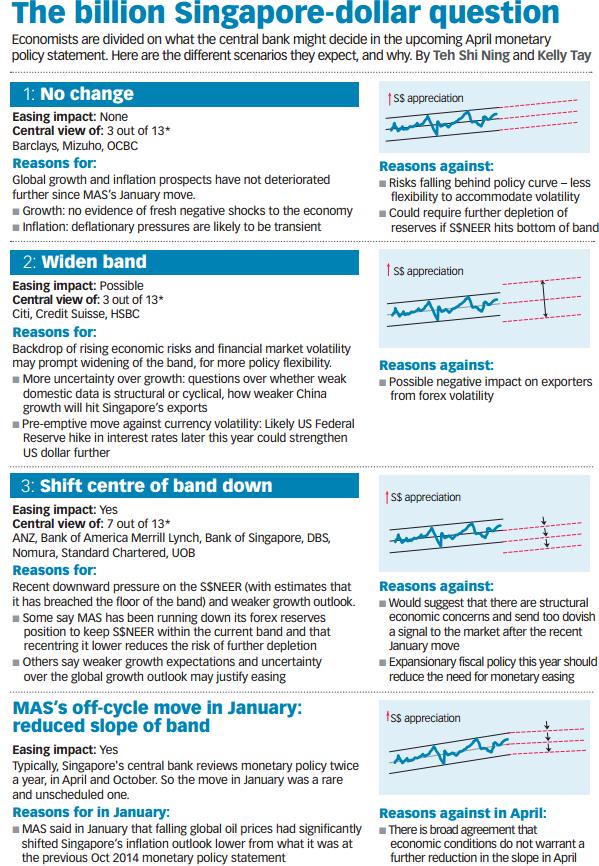

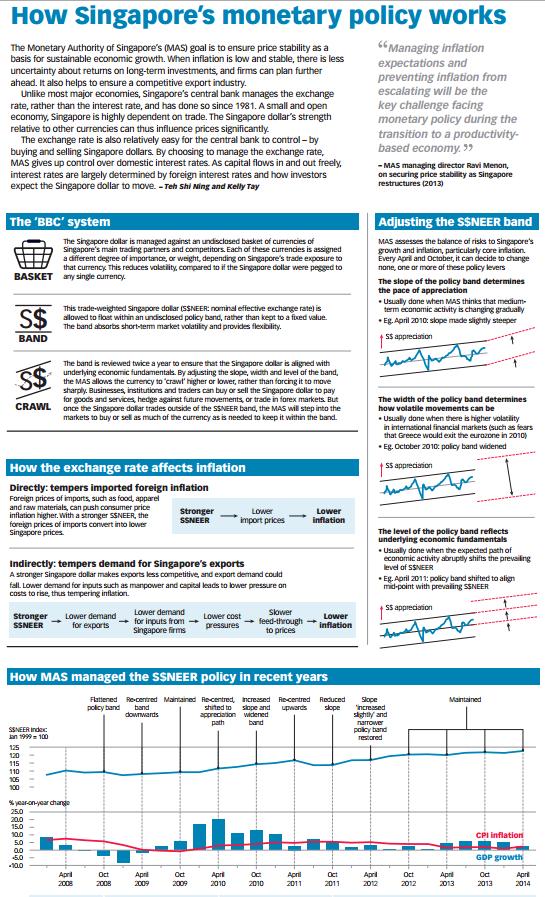

With MAS scheduled to release monetary policy data sometime in April, SGD INR could touch 57 in a knee jerk reaction or fall back to 54 in a quick move. There are analyst reports that suggest that with economy still not open to tourists SGD may continue to remain weak against the US Dollar. However, with housing prices inching up I don’t think MAS would want a weak dollar which would make Singapore properties cheaper for foreigners.

In a nutshell, I expect the roller coaster ride to continue and would take any move above 56.25 to transfer and invest in India. There is still value in some sectors of the equity markets and then there are low risk investments like Bharat Bond which I analysed in the previous post – Bharat Bond Better than NRE FD