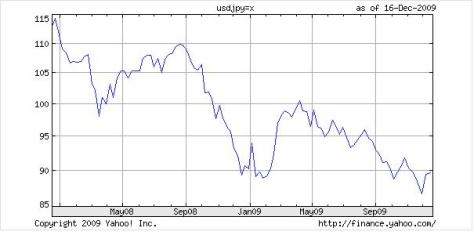

Forex trading and carry trade go hand in hand. A few years back it was USD against JPY, then the turn came for AUD against USD and recently people have been talking about EUR against USD on the prospects of US interests remaining low and Euro zone increasing rates to reign in inflation.

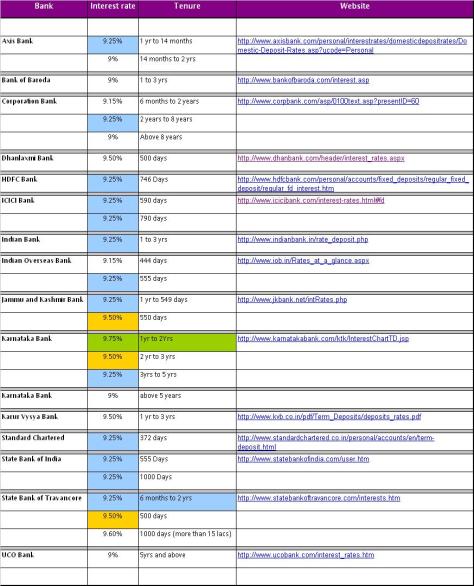

The key in all scenarios being large interest rate differentials that allow cheap borrowing in one currency and invetsing in the other. The usual trend is that the currency with the higher interest yield slowly gains against the lower interest rate currency.

AUD-USD moved from lows of 0.80 to 1.05 range gaining whopping 25%, the theme was similar for USD-JPY or EUR-USD.

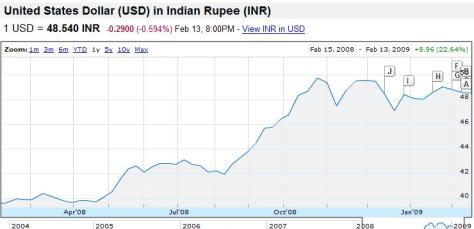

The Reserve Bank of India has gradually raised interest rates to 7.5% from lows of 3.5% over past 2 years and US still is at lows of below 0.5%. USD INR on the other hand has fluctuated between 44 – 47 in the same time with the

Now given that the interest rate differential is 7% and how other currencies have gained with the carry trade there is no reason why something similar would not happen with USD – INR. Indian Rupee should be strengthening against USD in line with how other currencies have performed.

Yes INR is a currency of a developing country and uses USD to pay for the Oil that it imports but that still does not completely negate the interest rate differential.

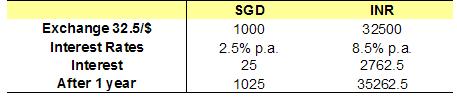

Using a simple calculation 1USD invested in India @ Rs.45 would grow to Rs48.37 in one year and seeing the trend of USD-INR fluctuating in a close 3% range there is every reason to enter the USD-INR carry trade.

What does this mean in layman terms?

1. It makes sense to borrow in US and invest in India

2. If you are earning in USD and do not have any need to hold US dollars its beneficial to remit to India and invest

3. If you want to trade then a USD INR carry looks like a low risk trade