Market has been rife about Singapore heading into a technical recession in 3rd Quarter of 2011. Prime Minister has revised the overall growth outlook downwards in the National Day speech and there has been a steady decline in the Electronics Export and other trading activities.

A technical recession occurs when a economy experiences negative growth for 2 consecutive quarters. To spur the economic growth I would expect the fiscal authority to ease out the rise in Singapore dollar to make exports more competetive. Lets look at what happened in the last technical recession of 2008.

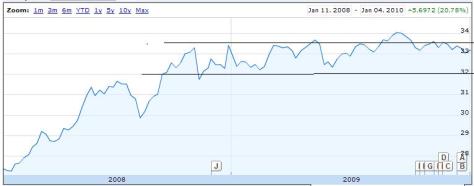

The Singapore dollar depreciated 14% against the USD and moved from 1.35 to 1.54 in a span of 6 months!!

Now what does this mean for SGD-INR that is had a spectacular run of 9% annualised appreaciation in past 4 years?

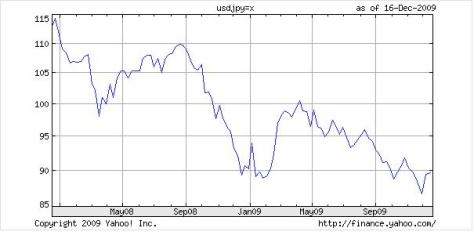

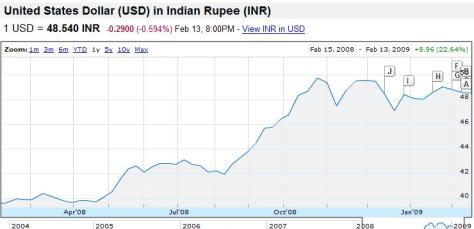

Simply speaking the SGD INR is a cross pair between SGD-USD and USD-INR therefore a weakening of SGD against USD would result in a decline in SGD – INR. The current USD-INR rate is 46.25 and SGD-USD is at 1.203. To get a better view lets see what happened to USD INR in the same period where SGD fell against the USD

USD – INR moved to 51.5 from 42 in the same time frame which is a gain of 20%.

Scenario 1

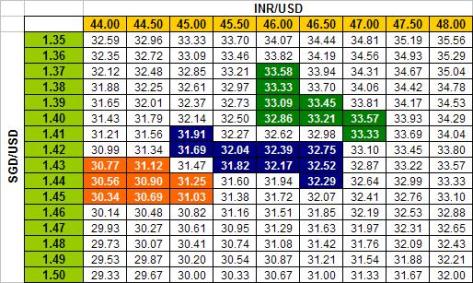

Using the two gain numbers of 14% and 20% the USD-SGD pair should move to 1.37 from 1.20 as of today and USD-INR would touch 55.5. The cross rate usinf these calculations would come out to 40.51 for SGD – INR.

I am sure all who have SGD holdings would get all excited seeing the figure, but before getting too excited lets look at other possibilities.

Scenario 2

The INR going beyond 50 mark will spell trouble for the Indian economy specially if the Oil prices remain around the $80 mark and the Reserve bank of India would intervene to stem the rise. So a possible future rate where the SGD weakens 14% the cross rate would come out to 36.50.

Scenario 3

Another possibility is that the SGD depreciates around 7-8% and moves to the 1.30 mark then SGD INR would be at the 38.46, assuming that INR moves to 50 against the USD which is also the current rate.

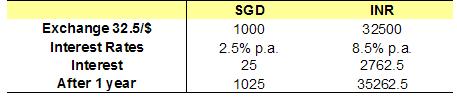

Now lets throw in the Interest Rate of 10% for Term Deposits in India – for a 6 month period from the current rate of 38.4 any money invested in India would yield 40.32 in target rate (tax free) which is close to the rates in scenario 1. On a post tax basis the amount would grow to yield 39.74.

So we have the facts lined up and no matter what the scenario is, repatriating money to India makes a lot of sense.