The US debt and budget talks finally reached a resolution yesterday, the congress passed the bill and the much feared US default was averted and the financial markets breathed a sigh of relief. Interestingly the Indian Rupee has been pretty flat both pre and post the US saga.

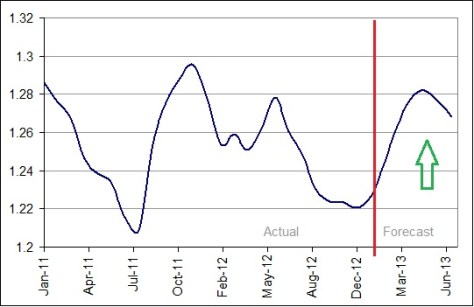

The drop to 69 against the USD on 28 August was the low point for the Rupee and it steadily regained lost ground in September (Rupee Doing a Bungee Jump – Time to bounce back?) and hovers around 61 as I write.

I often ask myself what has really changed in the past month but can’t find a fundamental reason for the pull back. My take is that it was a technical pull back with Rupee being oversold. Yes one could say that RBI got a new Governor in Raghuram Rajan and that helped Rupees cause, but if changing governors could help the Rupee strengthen by 15% then maybe RBI should abandon monetary policies and use governors to set the direction of the currency :).

Looking at the fundamentals nothing really has changed in the past 2 months – RBI did come up with a FCNR scheme, increase the duty on import of Gold and television sets and a benchmark rate increase. The FCNR scheme is reported to attract 10 billion USD in deposits which would add no more than 3% to the foreign currency reserves. The increase in duty on gold has got the premium over spot soaring in indian markets and made gold smuggling attractive and the increase in duty on television sets has made travel to Thailand and Singapore less attractive – believe it or not bringing in television sets from overseas trips was a great way of subsidizing foreign travel.

On the policy front nothing really has changed in India and no progress is expected until after the next elections in 2014. On the global front there is still a lot of uncertainty and the fear of Quantitative Easing (QE) taper is still there. The general consensus is for no taper before late march 2014 but its an event that will happen sooner or later.

With all the uncertainty and political wrangling I expect the Rupee to remain directionless to the year-end.

63 should act as the pivot against the USD with a variation of 5% either side – a range of 60-65 would be the order. However against the SGD things should be slightly different with 50 acting as a strong magnet.