Its hard to believe that we are already in February of 2013 and that calls for me to keep up on my promise and share with you my thoughts on SGD INR movements in the near term.

The trend so far has been inline with what I had expected in Dec 2012 – The pair has maintained the range of 42-46 with a downward bias (Read more: SGD-INR: How does 2013 look like?) and trades at 42.99 as I write.

SGD INR made multiple attempts to breach the 45 mark but have been unsuccessful. In the meantime a few interesting developments have happened on the fundamental front.

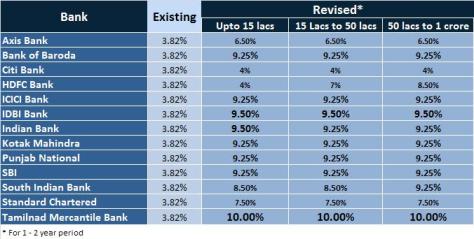

RBI came out and cut the rates by 25 basis points to stroke growth and the financial markets have taken a more “risk on” approach. The former would result in NRE deposit rates being lowered in the long term and the latter would attract FII in to the Indian Markets chasing growth.

At the same time the Indian Finance minister has promised financial reforms and started with reducing the fuel subsidies which helps reduce the Indian Budget deficit. This is also positive for the Rupee.

On the SGD front the currency has lost 2% against the USD and now trades at 1.24 as compared to 1.22 late last year.

These factors combined have seen SGD INR soften below 43 mark.

The question which people ask often is that how low will the pair fall and will SGD INR reach 45 again?

My view is that in the short term the pair would increase and move to cross the Rs.44 mark – The US debt ceiling discussions are due soon and so is Indian budget for 2013.

The uncertainty on the policy front would result in INR weakening against the USD which would mean a weaker INR against the SGD.

The recent spike in Crude Oil prices would add to woes for Indian Rupee.

So in-case the recent drop of SGD/INR has left you scrambling like Oct 2012 then don’t panic – next few weeks should give you an opportunity to see the pair touching 44 again.

Enjoy the Holidays and wishing you a very Happy Chinese New Year!! Gong Xi Fa Chai